Code

library(reticulate)This notebook demonstrates the use of Bayesian inference for sales forecasting using various probabilistic programming techniques. We will use the numpyro library to define and fit our models, and plotnine for visualization.

Bayesian inference allows us to incorporate prior knowledge and quantify uncertainty in our predictions. This notebook will guide you through the process of building a Bayesian model for sales forecasting, fitting the model using Markov Chain Monte Carlo (MCMC) and Stochastic Variational Inference (SVI), and visualizing the results.

library(reticulate)import os

import sys

# Set XLA_FLAGS before JAX is imported

os.environ["XLA_FLAGS"] = "--xla_force_host_platform_device_count=8"import polars as pl

import pandas as pd

import numpy as np

from plotnine import ggplot, aes, geom_point, geom_line, labs, theme_minimal, theme_bw, scale_x_continuous, scale_x_discrete, scale_x_datetime

import patsy

import jax

import jax.numpy as jnp

import jax.random as random

from jax.scipy.special import expit, logit

import numpyro

import numpyro.distributions as dist

#from numpyro.infer import SVI, Trace_ELBO, Predictive

from numpyro.infer import MCMC, NUTS, MCMC, NUTS #, SVI, Trace_ELBO

import arviz as az

import polars as pl

from plotnine import theme, guides, guide_legend

import pickle

#jax.config.update("jax_enable_x64", True) # Enable float64 by defaultIn this section, we define the Bayesian model used for sales forecasting. The model incorporates various components such as random walk for the latent state, day-of-the-week effects, day-of-the-year effects, and price elasticity. The model is implemented using the numpyro library, which allows for efficient and scalable Bayesian inference.

These auxiliary functions are essential for data preprocessing and transformation:

periodic_rbf: Computes a periodic Gaussian radial basis function (RBF).compute_doy_basis: Computes 12 periodic Gaussian basis functions for seasonal effects.read_data: Reads and preprocesses the sales data from a CSV file.init_values: Initializes values for the model parameters.# Define a periodic Gaussian radial basis function (RBF)

def periodic_rbf(x, mu, sigma):

"""

Computes a periodic Gaussian radial basis function (RBF).

Args:

x: Scaled day-of-year values (range [0,1]).

mu: Center of the Gaussian basis function.

sigma: Controls the spread of the Gaussian.

Returns:

RBF values preserving periodicity.

"""

# compute cyclic distance to mu

periodic_distance = jnp.minimum(jnp.abs(x - mu), 1 - jnp.abs(x - mu))

# compute RBF value

return jnp.exp(- (periodic_distance ** 2) / (2 * sigma ** 2))

def compute_doy_basis(yday_fraction, sigma = 30/365.25, n_centers = 12):

"""

Computes 12 periodic Gaussian basis functions for seasonal effects.

Args:

yday_fraction: Normalized day of the year (range [0,1]).

yday_factor: Scaling factor for basis function width.

Returns:

A JAX array with 12 columns representing the 12 monthly basis functions.

"""

# Define centers of Gaussian basis functions

month_centers = jnp.linspace( 1/(2*n_centers), 1-1/(2*n_centers), n_centers)

# Generate an array of shape (length of input, 12) with the RBF values

doy_basis = jnp.stack([periodic_rbf(yday_fraction, mu, sigma) for mu in month_centers], axis=-1)

# Subtract each row's mean to enforce sum-to-zero constraint

doy_basis_centered = doy_basis - jnp.mean(doy_basis, axis=-1, keepdims=True)

return doy_basis_centered

def read_data(fname, n_rows=None):

"""

Reads and preprocesses the sales data from a CSV file.

Args:

fname: The filename of the CSV file containing the sales data.

Returns:

A dictionary with the following keys:

- sales: An array of sales data.

- log_price: An array of log-transformed prices.

- wday: An array of day-of-the-week values.

- yday_fraction: An array of normalized day-of-the-year values.

"""

# Read the CSV file using polars

df = pl.read_csv(fname)

# Keep only the first n_rows if specified

if n_rows is not None:

df = df.head(n_rows)

# Convert the 'date' column to date type

df = df.with_columns(pl.col("date").str.to_date())

# Extract sales, and log price data as a numpy arrays

sales = df["sales"].to_numpy()

log_price = df["log_price"].to_numpy()

# Extract day-of-the-week values

wday = df["date"].dt.weekday().to_numpy() # set offset to 0

# Extract day-of-the-year values

yday = df["date"].dt.ordinal_day().to_numpy()

# Determine if the year is a leap year

is_leap_year = df["date"].dt.is_leap_year().to_numpy()

# Normalize day-of-the-year values

yday_fraction = yday / (365 + is_leap_year)

# Return the preprocessed data as a dictionary

return {

"date": df["date"].to_numpy(),

"sales": sales,

"log_price": log_price,

"wday": wday,

"yday_fraction": yday_fraction

}

def interpolate(x, downsampling_factor, n_out):

"""

"""

idx_n_weight = jnp.array(range(0, n_out))/jnp.float64(downsampling_factor)

idx_1 = jnp.array( jnp.floor(idx_n_weight), dtype=int)

idx_2 = jnp.array( jnp.ceil(idx_n_weight), dtype=int)

weight_2 = idx_n_weight - idx_1

state_before = x[idx_1]

state_after = x[idx_2]

return (1-weight_2)*state_before + weight_2*state_after

def chunked_mean(x, n_chunk):

n = x.shape[0]

pad_size = -n % n_chunk # compute padding needed to make k a multiple of n

x_padded = jnp.pad(array = x, pad_width = (0, pad_size), mode = 'edge') # pad at the end

return x_padded.reshape(-1, n_chunk).mean(axis=1)

def chunked_sum(x, n_chunk):

n = x.shape[0]

pad_size = -n % n_chunk # compute padding needed to make k a multiple of n

x_padded = jnp.pad(array = x, pad_width = (0, pad_size)) # pad at the end

return x_padded.reshape(-1, n_chunk).sum(axis=1)# Creates a simple plot using plotnine

def plot_function(x, y, title, xlab, ylab):

# Convert x to numpy array

x = np.array(x)

# Check if y is a callable function

if callable(y):

# If y is a function, apply it to x and create a DataFrame

df = pd.DataFrame({"x": x, "y": y(x)})

else:

# If y is not a function, create a DataFrame directly

df = pd.DataFrame({"x": x, "y": y})

# Create the plot using ggplot

plot = (ggplot(df, aes(x="x", y="y")) + geom_line() + labs(title=title, x=xlab, y=ylab) + theme_bw())

# Return the plot

return plotWe model the sales time series as a stochastic process where the underlying rate of sales evolves over time. This evolution follows a random walk structure, but with systematic adjustments for covariates such as price, day-of-the-week effects, and day-of-the-year effects. The rate of sales \(\lambda_t\) on day \(t\) is a function of captures (i) systematic covariate effects (\(z_t\)), (ii) a global baseline (\(\mu_\tau\)), and (iii) the latent dynamic component (\(\tau_t\)).

\[ log~\lambda_t = z_t + \mu_\tau + \tau_t \]

The baseline sales level \(\tau_t\) follows a random walk. Because all contrast matrices for structured effects are centered, \(\mu_\tau + \tau_t\) can be interpreted as the average latent sales rate on \(\tau_t\).

\[ \tau_t = \tau_{t-1} + \delta_t, \quad \delta_t \sim \mathcal{N}(0, \sigma_\tau) \]

with:

\[ \mu_\tau \sim \text{Exponential}(1), \quad \sigma_\tau \sim \mathcal{N}(1) \]

We further accounted for systematic effects of (i) day of the week, (ii) day of the year, and (iii) price.

Similarly, the day-of-the-year effects are modeled using a seasonality basis matrix \(\mathbf{B}_{\text{yday}}\), which represents periodic seasonal patterns using Gaussian radial basis functions (RBFs).

\[ zw_t = \mathbf{C}_{\text{wday}} \cdot \beta_{\text{wday}}, \quad \beta_{\text{wday}} \sim \mathcal{N}(0, 1) \]

\[ zy_t = \mathbf{B}_{\text{yday}} \cdot \beta_{\text{yday}}, \quad \beta_{\text{yday}} \sim \mathcal{N}(0, 1) \]

\[ ze_t = \text{log\_price\_centered} \cdot e, \quad \log(-e) \sim \mathcal{N^{+}}(0, 1) \]

\[ z_t = zw_t + zy_t + ze_t \]

Observed sales are assumed to follow a Poisson distribution, ensuring discrete, non-negative observations:

\[ S_t \sim \text{Poisson}(\lambda_t) \]

def model_local_level_poisson(sales: jnp.array, log_price_centered: jnp.array, wday: jnp.array, yday_fraction: jnp.array,

contrasts_sdif_t: jnp.array, contrasts_wday: jnp.array, contrasts_yday: jnp.array,

downsampling_factor = 1):

"""

"""

n_obs = len(sales)

n_states = contrasts_sdif_t.shape[0]

def sample_random_walk(contrasts_sdif_t, n_states):

log_sigma = numpyro.sample("log_sigma", dist.Gumbel(0, 5))

sigma = numpyro.deterministic("sigma", jnp.exp(log_sigma))

log_state_mean = numpyro.sample("log_state_mean", dist.Normal(0, 5)) # to-do: add an average drift term, as well as potentially an additional parameter governing drift dynamics

log_state_delta = numpyro.sample( "log_state_delta", dist.Normal(0, 1), sample_shape=(n_states-1,))

log_state_base = numpyro.deterministic("log_state_base", jnp.dot(contrasts_sdif_t, log_state_delta) * sigma + log_state_mean )

return log_state_base

def sample_downsampled_random_walk(contrasts_sdif_t, n_obs, n_states):

log_state_base_downsampled = sample_random_walk(contrasts_sdif_t, n_states)

log_state_base = interpolate(log_state_base_downsampled, downsampling_factor, n_obs)

return log_state_base

def sample_wday_effect(contrasts_wday, wday):

# Prior for day-of-the-week effects (6 coefficients)

wday_coefficients = numpyro.sample("wday_coefficients", dist.Normal(0, 1), sample_shape=(6,))

# Compute wday effect per observation (sum-to-zero constraint applied via contrasts)

wday_effects = jnp.dot(contrasts_wday, wday_coefficients)

return jnp.array(wday_effects[wday-1])

def sample_yday_effect(contrasts_yday, yday_fraction):

# Prior for yearly seasonality effects (12 coefficients)

yday_coefficients = numpyro.sample("yday_coefficients", dist.Normal(0, 1), sample_shape=(12,))

return jnp.dot(contrasts_yday, yday_coefficients)

def sample_price_effect(log_price_centered):

# Prior for price elasticity

elasticity_pos = numpyro.sample( "elasticity_pos", dist.HalfNormal(10) )

elasticity = numpyro.deterministic("elasticity", -1 * elasticity_pos)

return log_price_centered * elasticity

# Sample random walk

if n_obs == n_states:

log_state_base = sample_random_walk(contrasts_sdif_t, n_states)

else:

log_state_base = sample_downsampled_random_walk(contrasts_sdif_t, n_obs, n_states)

# Sample day-of-the-week effects

wday_effect = sample_wday_effect(contrasts_wday, wday)

# Sample day-of-the-year effects

yday_effect = sample_yday_effect(contrasts_yday, yday_fraction)

# Sample elasticity effect

price_effect = sample_price_effect(log_price_centered)

# Compute state

state = numpyro.deterministic("state", jnp.exp( log_state_base + yday_effect + wday_effect + price_effect )) # #

# Compute log-likelihood for poisson emissions

numpyro.sample("sales", dist.Poisson(rate=state), obs=sales) # to-do: create a Poisson distribution paramaterized by log-rate, as in the Stan manual We use the run_nuts function to fit the model to our sales data. The function leverages the No-U-Turn Sampler (NUTS) from the numpyro library to perform MCMC sampling. Because the model has a large number of latent parameters, initialization to sensible start values is key.

In order to fit the model, the functions below are used:

prepare_model_arguments: Transforms the data into a format required by the model, including sales data, log-transformed prices, day-of-the-week values, and normalized day-of-the-year values.

init_values: Finds sensible start values for the model parameters which, in this case is crucial for the convergence of the MCMC algorithm.

run_nuts: Given a dataset, it calls the NUTS sampler to perform MCMC sampling.

def init_values(sales: jnp.array, log_price_centered: jnp.array, wday, yday_fraction: jnp.array, downsampling_factor = 1):

"""

"""

epsilon = 0.001

log_state_est = jnp.log(sales + epsilon)

log_state_mean_est = jnp.mean(log_state_est)

log_state_delta_est = jnp.diff(log_state_est)

if downsampling_factor > 1:

log_state_delta_est = chunked_sum(log_state_delta_est, downsampling_factor)

log_state_delta_sd_est = jnp.std(log_state_delta_est)

return {

"log_sigma": jnp.log( log_state_delta_sd_est ),

"log_state_mean": log_state_mean_est,

"log_state_delta": log_state_delta_est,

"wday_coefficients": jnp.array([0.0]*6),

"yday_coefficients": jnp.array([0.0]*12),

"log_elasticity": jnp.array([0.0])

}def prepare_model_arguments(sales: jnp.array, log_price: jnp.array, wday: jnp.array, yday_fraction: jnp.array, downsampling_factor = 1):

"""

Prepares the arguments required for the model.

Args:

sales: Array of sales data.

log_price: Array of log-transformed prices.

wday: Array of day-of-the-week values.

yday_fraction: Array of normalized day-of-the-year values.

downsampling_factor: Factor by which to downsample the data.

Returns:

A tuple containing initialized values for the model parameters and the model arguments.

"""

n_obs = len(sales)

# Determine the number of states based on the downsampling factor

if downsampling_factor == 1:

n_states = n_obs

else:

n_states = int(np.ceil(n_obs / downsampling_factor) + 1)

# Define contrast matrix for random walk (T coefficients, sum-to-zero constraint)

contrasts_sdif_t = patsy.contrasts.Diff().code_without_intercept(range(0, n_states)).matrix

# Define contrast matrix for day-of-the-week effects (6 coefficients, sum-to-zero constraint)

contrasts_wday = patsy.contrasts.Diff().code_without_intercept(range(0, 7)).matrix # 7 days → 6 contrasts

# Compute yday effect per observation (sum-to-zero constraint applied via contrasts)

contrasts_yday = compute_doy_basis(yday_fraction, sigma=30/365.25, n_centers=12) # to-do: do a very approximate calibration of the RBF width parameter sigma, using something like a spline for the long term trend + RBF seasonality

# Compute centered log price differences

log_price_centered = log_price - jnp.mean(log_price)

# Set up the model parameters

model_arguments = {

'sales': sales,

'log_price_centered': log_price_centered,

'wday': jnp.array(wday, dtype=int),

'yday_fraction': yday_fraction,

'downsampling_factor': downsampling_factor,

'contrasts_sdif_t': contrasts_sdif_t,

'contrasts_wday': contrasts_wday,

'contrasts_yday': contrasts_yday

}

# Prepare initial values for parameters

init_params = init_values(sales, log_price_centered, wday, yday_fraction, downsampling_factor)

return init_params, model_argumentsdef run_nuts(sales: jnp.array, log_price: jnp.array, wday, yday_fraction: jnp.array, downsampling_factor = 1, n_chains = 1, num_warmup=1_000, num_samples=1_000, step_size=0.01, max_tree_depth=8):

""" Runs NUTS MCMC inference on the model

"""

# Initialize random number generator key

rng_key = random.PRNGKey(0)

# Get the number of observations

n_obs = len(sales)

# Prepare model arguments and initial parameter values

init_params, model_arguments = prepare_model_arguments(sales = sales, log_price = log_price, wday = wday, yday_fraction = yday_fraction, downsampling_factor = downsampling_factor)

# Split the random number generator key

rng_key, rng_key_ = random.split(rng_key)

# Set the number of chains for parallel sampling

numpyro.set_host_device_count(n_chains)

# Define the model to be used

reparam_model = model_local_level_poisson

# Initialize the NUTS kernel with the specified step size and tree depth

kernel = NUTS(reparam_model, step_size=step_size, max_tree_depth=max_tree_depth)

# Initialize the MCMC sampler with the NUTS kernel

mcmc = MCMC(kernel, num_warmup=num_warmup, num_samples=num_samples, num_chains=n_chains)

# Run the MCMC sampler

mcmc.run(rng_key_, **model_arguments) # disable init values: init_params=init_params

# Return the fitted MCMC object

return mcmc, model_argumentsrun_nuts function. The model is fitted using the No-U-Turn Sampler (NUTS) from the numpyro library, with 4 chains, 1,000 warmup iterations, and 1,000 sampling iterations. The step size is set to 0.01, and the maximum tree depth is 8. The fitted model is stored in the m_fit variable.# read in the synthetic sales data

data = read_data("sales_synthetic.csv")with open("sim_parameters.pkl", "rb") as f:

sim_parameters = date_range, growth, growth_plus_rw, scale_factor, wday, weekly_seasonality, yearly_seasonality = pickle.load(f)# Fit the model using NumPyro NUTS MCMC

m_fit, model_arguments = run_nuts(data['sales'], data['log_price'], data['wday'], data['yday_fraction'],

downsampling_factor=7, n_chains=4, num_warmup=1_000, num_samples=1_000,

step_size=0.01, max_tree_depth=8)/home/pavel/.cache/uv/archive-v0/mUjrPOYClnQf0pTSkamJu/lib/python3.11/site-packages/jax/_src/numpy/scalar_types.py:50: UserWarning: Explicitly requested dtype float64 requested in asarray is not available, and will be truncated to dtype float32. To enable more dtypes, set the jax_enable_x64 configuration option or the JAX_ENABLE_X64 shell environment variable. See https://github.com/jax-ml/jax#current-gotchas for more.

0%| | 0/2000 [00:00<?, ?it/s]

Compiling.. : 0%| | 0/2000 [00:00<?, ?it/s]

0%| | 0/2000 [00:00<?, ?it/s][A

Compiling.. : 0%| | 0/2000 [00:00<?, ?it/s][A

0%| | 0/2000 [00:00<?, ?it/s][A[A

Compiling.. : 0%| | 0/2000 [00:00<?, ?it/s][A[A

0%| | 0/2000 [00:00<?, ?it/s][A[A[A

Compiling.. : 0%| | 0/2000 [00:00<?, ?it/s][A[A[AAll effective sample sizes are decent, which is a good sign. The Gelman-Rubin statistics are close to 1, indicating convergence. Inspection of trace plots are beyond the scope of this notebook.

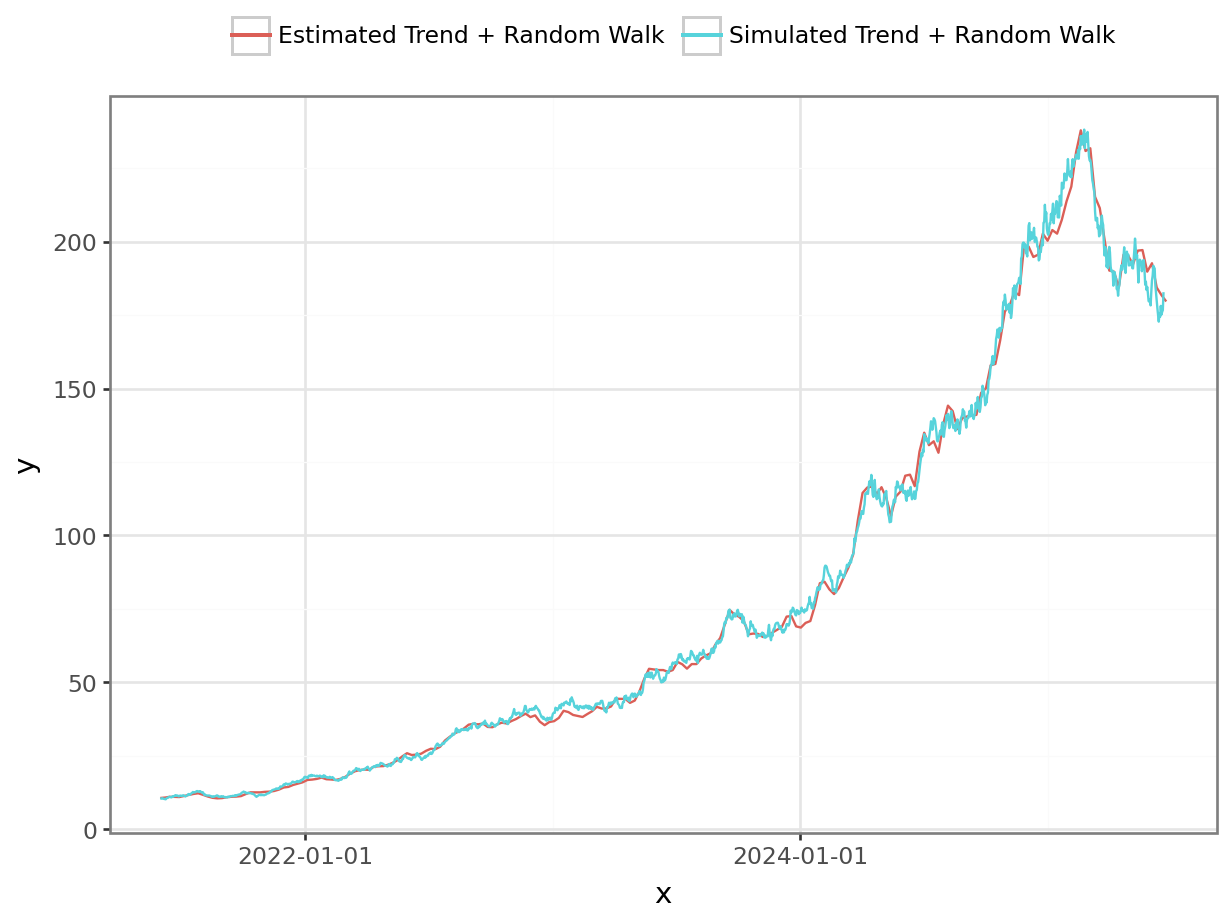

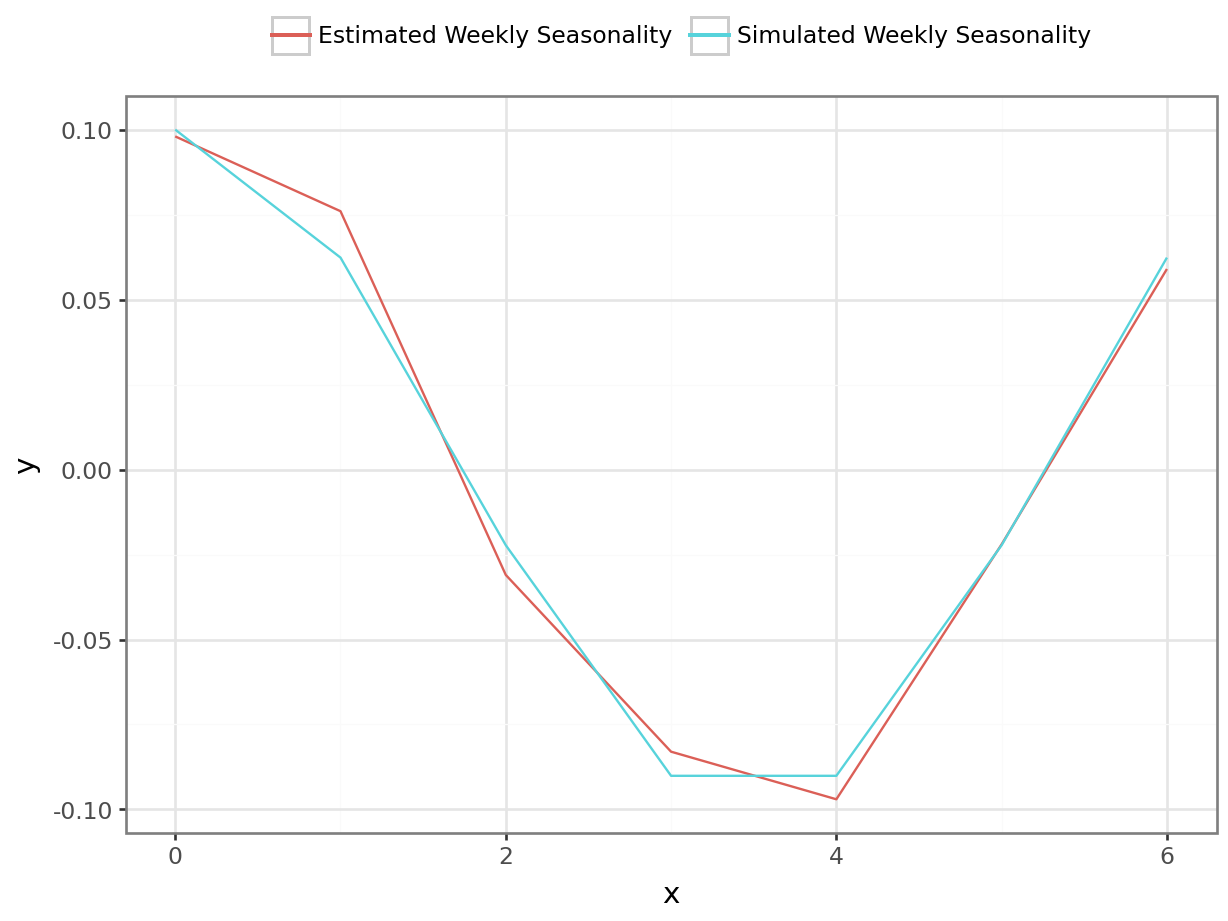

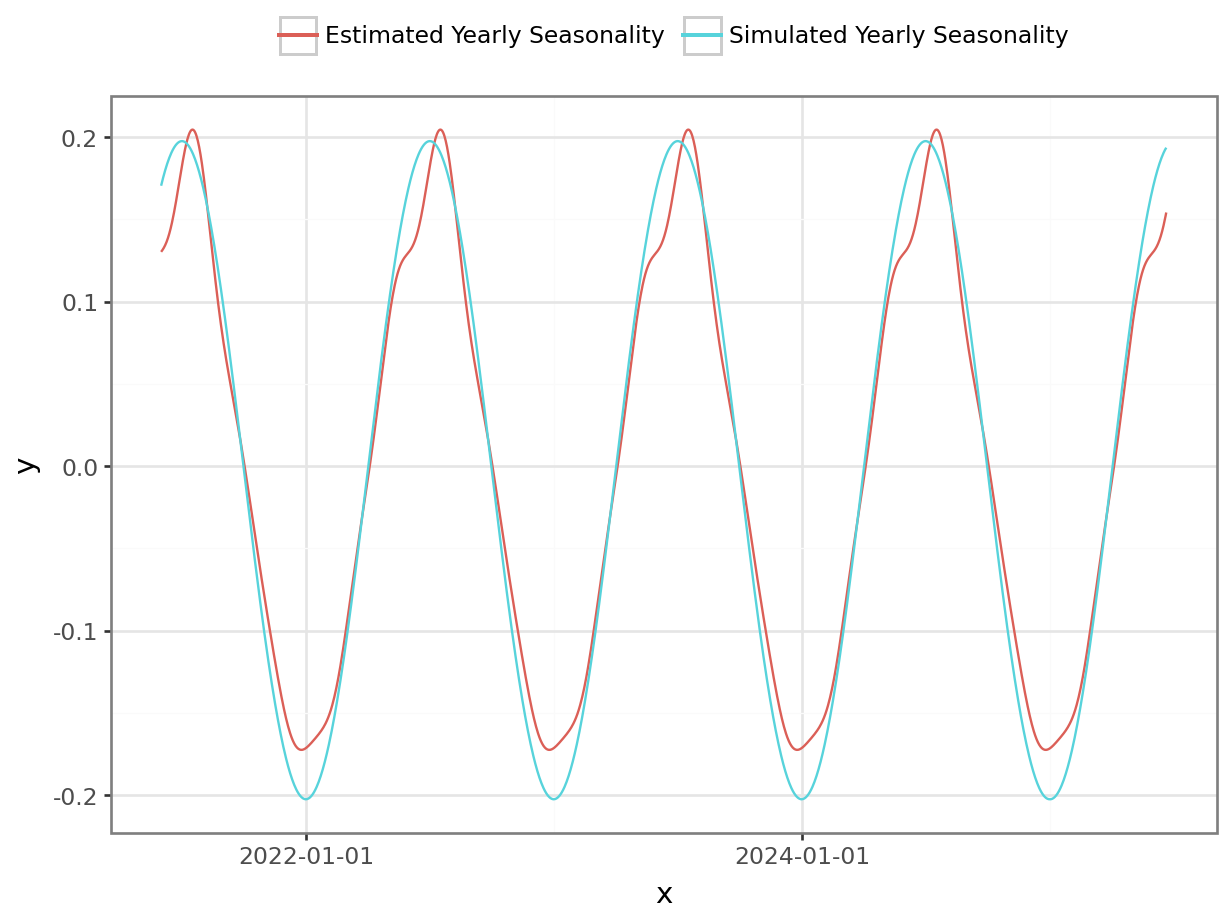

The model successfully reconstructs all key features of the synthetic dataset.

# Let's look at the estimated random walk component of the model.

summary = az.summary(m_fit, var_names=["sigma", "log_state_delta"], filter_vars="like")py$summary# Create a sequence of dates starting at data["date"].min() the length of x['mean'], in steps of 7 days

rw_states = az.summary(m_fit, var_names=["log_state_base"], filter_vars="like")["mean"].to_numpy()/home/pavel/.cache/uv/archive-v0/mUjrPOYClnQf0pTSkamJu/lib/python3.11/site-packages/jax/_src/numpy/scalar_types.py:50: UserWarning: Explicitly requested dtype float64 requested in asarray is not available, and will be truncated to dtype float32. To enable more dtypes, set the jax_enable_x64 configuration option or the JAX_ENABLE_X64 shell environment variable. See https://github.com/jax-ml/jax#current-gotchas for more.dates = pd.date_range(start = data["date"].min(), periods = len(rw_states), freq='7D')

#p = plot_function(dates, np.exp(rw_states), "Estimated Random Walk Component", "Date", "Sales") # to-do: add uncertainty bands

df_1 = pl.DataFrame({'x': date_range, 'y': growth_plus_rw*scale_factor, 'var': 'Simulated Trend + Random Walk' })

df_2 = pl.DataFrame({'x': dates, 'y': np.exp(rw_states), 'var': 'Estimated Trend + Random Walk' })

df = pl.concat([df_1, df_2])

p = ggplot(df, aes("x", "y", color = "var")) + geom_line() + theme_bw() + theme(legend_position='top') + guides(color=guide_legend(title=""))

_ = p.draw(show=True)

coefs_wday = az.summary(m_fit, var_names=["wday_coefficients"], filter_vars="like")py$coefs_wdaywday_effect = jnp.dot(model_arguments["contrasts_wday"], jnp.array(coefs_wday["mean"]))

p = plot_function(range(0,7), wday_effect, "Effect of Day of the Week", "Date", "Sales") # to-do: add uncertainty bands

df_1 = pl.DataFrame({'x': range(0,7), 'y': weekly_seasonality - np.mean(weekly_seasonality), 'var': 'Simulated Weekly Seasonality' })

df_2 = pl.DataFrame({'x': range(0,7), 'y': wday_effect.tolist(), 'var': 'Estimated Weekly Seasonality' })

df = pl.concat([df_1, df_2])

p = ggplot(df, aes("x", "y", color = "var")) + geom_line() + theme_bw() + theme(legend_position='top') + guides(color=guide_legend(title=""))

_ = p.draw(show=True)

coefs_yday = az.summary(m_fit, var_names=["yday_coefficients"], filter_vars="like")py$coefs_ydayyday_effect = jnp.dot(model_arguments["contrasts_yday"], jnp.array(coefs_yday["mean"]))

#p = plot_function(data["date"], yday_effect, "Yearly Seasonality", "Date", "Sales") # to-do: add uncertainty bands

df_1 = pl.DataFrame({'x': date_range, 'y': yearly_seasonality - np.mean(yearly_seasonality), 'var': 'Simulated Yearly Seasonality' }).with_columns(

pl.col("x").cast(pl.Date)

)

df_2 = pl.DataFrame({'x': data["date"].tolist(), 'y': yday_effect.tolist(), 'var': 'Estimated Yearly Seasonality' })

df = pl.concat([df_1, df_2])

p = ggplot(df, aes("x", "y", color = "var")) + geom_line() + theme_bw() + theme(legend_position='top') + guides(color=guide_legend(title=""))

_ = p.draw(show=True)

summary = az.summary(m_fit, var_names=["elasticity"])py$summaryThis case study demonstrates how Bayesian modeling can effectively decompose sales variance into meaningful components, providing a structured way to analyze the underlying factors driving sales fluctuations. By applying this approach to a synthetic dataset, we validated the model’s ability to separate out long-term growth, seasonal effects, and price sensitivity while simultaneously quantifying uncertainty.

The key takeaways include:

Decomposing complexity: The model successfully isolates different components influencing sales, making it easier to interpret real-world dynamics.

Quantifying uncertainty: In addition to point estimates, Bayesian inference provides full posterior distributions, enabling better risk assessment.

Informed decision-making: By accounting for all sources of variance, businesses can make more confident strategic decisions that explicitly consider uncertainty. For instance, price optimization can be performed on the entire posterior distribution of the estimate of the price elasticity of demand.

These findings highlight the advantages of probabilistic modeling in sales analysis, offering a flexible and interpretable method.